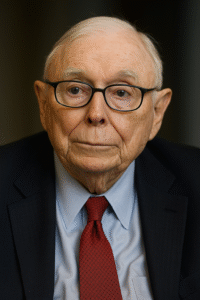

A Brilliant Mind: Charlie Munger the Investor and Strategist

The world lost an investing legend in 2023 with the passing of the beloved Charlie Munger only weeks short of reaching 100 years old.

Warren Buffett once remarked, “Charlie has the best 30-second mind in the world.”

This is a tribute to his longtime investing partner’s ability to grasp complex ideas rapidly. Here, we explore what truly set Charlie apart: the 13 Mental Models that he employed, blending rapid understanding with deep, strategic thought.

1. Circle of Competence: Focus on familiar expertise areas.

2. Inversion: Solve problems by considering them in reverse.

3. First Principles Thinking: Break problems into basic elements.

4. Margin of Safety: Adopt a conservative, buffer-inclusive approach.

5. Psychology of Misjudgment: Understand human biases.

6. Checklists: Use checklists for comprehensive decision-making.

7. Paradox of Tolerance: Balance open-mindedness with boundaries.

8. Complex Adaptive Systems: Recognize interconnected systems.

9. Network Effects: Value the amplifying power of networks.

10. Competitive Advantages & Moats: Seek companies with durable competitive edges.

11. Redundancy: Implement backup systems to mitigate risks.

12. Second-Order Thinking: Consider long-term consequences.

13. Lollapalooza Effect: Combine various models for complex understanding

Charlie Munger’s success provides valuable lessons for investors and business professionals. Leveraging these models enhances good decision-making, blending speed with strategic depth and foresight.

Charlie, RIP. You will be dearly missed. You broke the mold.

#strategicvision #charliemunger #warrenbuffet #solvingproblems #mentalmodels #investing #financialplanning